Getting the best from Asset Management Maturity Assessments

In this article Asset Dynamics’ Andrew Gatland considers the role and limitations of asset management maturity assessments, and how to realise maximum value from your next assessment.

The Infrastructure Commission on asset management maturity assessments

Te Waihanga New Zealand Infrastructure Commission’s Report “Taking Care of Tomorrow Today: Asset Management State of Play” published late 2024 provides a perspective on asset management maturity across New Zealand’s infrastructure sectors covering energy, telecommunications, three waters, transport, health, community assets, education assets, justice, defence, and land and forestry. The goal of the report was to learn what is working and what is not, the reasons for this and what improvements can be made.

There is a lot at stake. As previous research by the Infrastructure Commission has identified, New Zealand cannot afford to build its way out of its current and future infrastructure challenges. Attempting to do so would cost an estimated $31 billion per year, almost twice what is currently being spent. Inaction will result in deteriorating levels of service and intolerable risk in critical infrastructure. The only response is to do more with less — and this will require a significant uplift in asset management maturity.

The Asset Management State of Play provides eight “Key Recommendations”, the third of which is that public major infrastructure providers be required to periodically undertake an independently verified asset management maturity assessment and publicly report on the results. The report further recommends other major infrastructure providers should also meet this requirement, especially when they provide critical infrastructure.

“Key Recommendation 3: Require all public major infrastructure providers to periodically undertake an independently verified asset management maturity assessment and publicly report on the results. Other major infrastructure providers should meet this requirement especially where they are providing critical infrastructure. ”

We agree that asset management maturity assessments can be a valuable source of feedback to support improvement of asset management capability for the infrastructure organisation. In this article we consider the role and limitations of asset management maturity assessments and then provide practical guidance on how organisations can realise maximum value from such work, while managing down the risk of producing reports that do not lead to action.

What is asset management maturity?

The role of asset management is to ensure the organisation realises maximum value from its assets over multiple time horizons. Asset management is a strategic business capability (like financial management, human resources management, etc.), and it follows that if the organisation is more capable in asset management, value realisation is more likely to be achieved.

The Global Forum on Maintenance and Asset Management defines asset management maturity as “the extent to which the capabilities, performance and ongoing assurance of an organisation are fit for purpose to meet the current and future needs of its stakeholders, including the ability of an organisation to foresee and respond to its operating context.”

The role of the asset management maturity assessment is therefore to objectively assess and provide feedback to the organisation on the extent to which its capabilities are fit for purpose to meet current and future requirements, and whether those capabilities are in fact delivering required performance. The assessment should also consider whether the organisation has adequate predictive capabilities to identify and respond to emergent issues in its environment.

Assessing asset management maturity

Assessing asset management maturity is not straightforward because of the breadth of the discipline, the range of contexts and environments where asset management is relevant, and the inherent subjectivity in any assessment of complex human systems.

The Institute of Asset Management’s Maturity Scale and Guidance separates its maturity scale into two main categories represented by the “Asset Management maturity ‘bow tie’ diagram”. On the left of the bow tie there is convergence of practices to the knot which represents “competence”, which might be conformance to a reference standard such as ISO 55001. On the right of the bow tie there is a divergence of practices as competent organisations further mature their asset management capability based upon their own context and requirements.

This suggests that standard maturity assessment frameworks may be appropriate for organisations in the early stages of developing their asset management capability, however beyond the point that the organisation conforms with ISO 55001, a more customised approach is needed, which reflects the circumstances of the organisation or perhaps a similar peer group.

The Infrastructure Commission’s high-level maturity assessment reports generally lower levels of maturity across New Zealand’s infrastructure sector, and therefore the focus of the following guidance is on the application of standard maturity assessment frameworks.

Selecting an asset management maturity assessment framework

The selection of the assessment criteria is an important consideration that likely impact the outcomes and recommendations that flow from the assessment. It is desirable that the criteria be selected for application in multiple successive assessments so that time series of maturity can be tracked. This means that results can be compared across multiple periods, and it provides a perspective on the performance of improvement actions delivered since the last assessment.

There are a range of frameworks in use in New Zealand including:

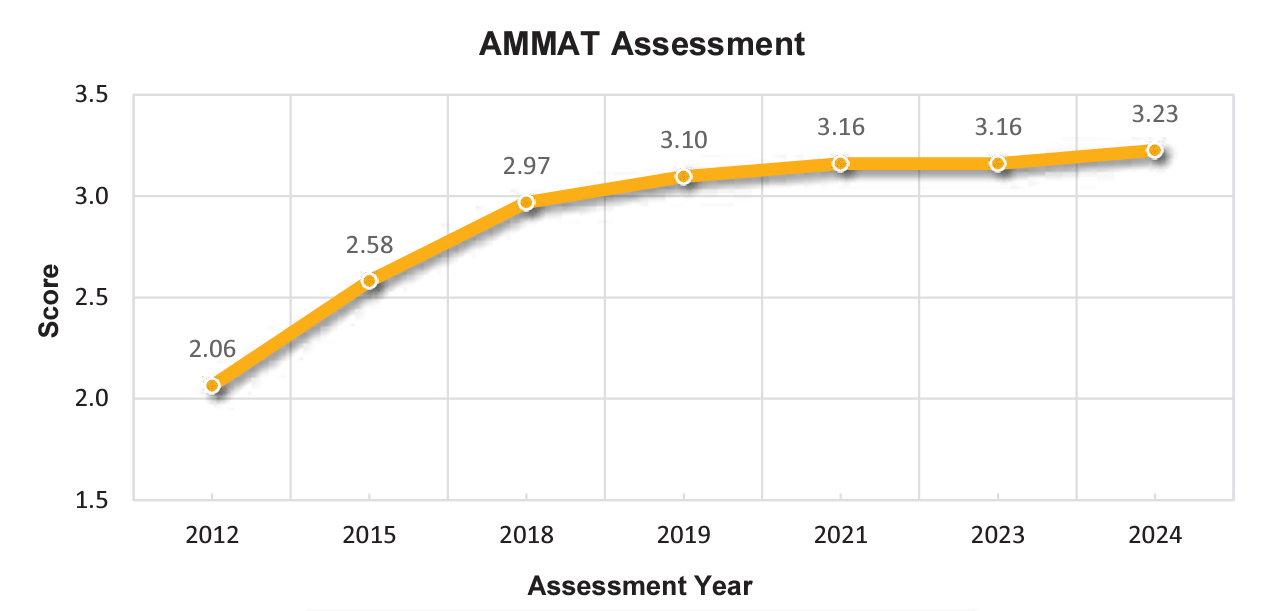

Commerce Commission’s Asset Management Maturity Assessment Tool (AMMAT).

Institute of Asset Management Self-Assessment Methodology Tool (SAM+)

Treasury Investor Confidence Report (ICR) Asset Management Maturity assessment.

International Infrastructure Management Manual (IIMM) Asset Management Maturity Framework.

Conformance audit/assessment against requirements of asset management standards such as ISO 55001 and PAS 55.

Proprietary assessment frameworks developed by consultancies based upon relevant standards and bodies of knowledge, for example ISO 55001, GFMAM Asset Management Landscape.

When selecting the assessment criteria the goals of the assessment need to be considered. New Zealand electricity distributors are required by regulation to complete and disclose self-assessments under the Commerce Commission’s AMMAT. Some organisations have set a goal of becoming ISO 55001 aligned or certified, making an assessment that provides feedback on current conformance with this standard relevant.

Another factor is use of an assessment framework that is in common use amongst peer group organisations. New Zealand’s Local Government organisations often use the IIMM Asset Management Maturity Framework as it was developed by practitioners in that sector, meaning it is familiar, and it allows peer group benchmarking.

During 2024 ISO 55001 and the Asset Management Landscape were updated, integrating global asset management knowledge into the form of an international standard and body of knowledge respectively. Organisations aspiring to contemporary good practice may consider assessment frameworks that recognise the contribution of these documents.

Selecting an assessor

The role of the asset management assessor is to understand the goals of the organisation in undertaking the assessment, gather data, analyse that data with respect to the selected maturity assessment framework, report on the results of the assessment, and provide recommendations that respond to the goals of the assessment. Delivering an effective asset management assessment is a complex undertaking that requires a range of skills and expertise:

Asset management knowledge across the range of subjects defined in the Asset Management Landscape

Experience and knowledge of the relevant industry or sector

Understanding of management systems and relevant standards

Audit skills to implement an audit process such as that set out in ISO 19011:2018

Data analysis

People skills

Presentation skills

Project management

In recognition of broad asset management knowledge that is required to deliver an effective asset management maturity assessment, the World Partners in Asset Management established the Certified Asset Management Assessor (CAMA) credential. In addition to establishing an individual’s credentials in asset management knowledge, the CAMA Certification also meets the requirements for the Joint Australian and New Zealand Asset Management Systems Scheme. All auditors of ISO 55001 asset management systems in the region must hold this certification.

Attaining the CAMA Certification requires candidates to pass an exam. They are then entitled to be included on the CAMA Register. There are now 1,485 people with CAMA certification globally, including 42 in New Zealand.

Relevant asset management experience in the industry or a similar industry (e.g., utilities, manufacturing, etc.) is a valuable attribute for an assessor. In addition to providing valuable knowledge and expertise to draw from, it also facilitates communication between the organisation and the assessor. Diverse experience across a range of industries may also be considered an advantage, as feedback generated through cross-pollination of good practices may lead to valuable recommendations, and even the development of new knowledge-sharing relationships between organisations.

Audit disciplines are relevant to the effective delivery of an asset management maturity assessment. This includes the competence of the assessor in carrying out the assessment and personal behaviours that will lead to a successful outcome. A key competency is the ability to collect data in the assessment. Audit skills such as conducting interviews, reviewing technical and non-technical documentation, and observing work tasks are relevant here. ISO 19011 defines the following desired professional behaviours of auditors, that are equally relevant to those carrying out an asset management maturity assessment: ethical, open-minded, diplomatic, observant, perceptive, and versatile.

These considerations should be taken into account by organisations engaging external support to deliver an asset management maturity assessment, or when selecting internal staff to facilitate a self-assessment.

Realising value from an asset management maturity assessment

While it is the role of the assessor to deliver the assessment, it is the actions of the organisation that will determine whether value is realised from it. In our work we often see situations where asset management maturity assessments have been commissioned but months or years on, the feedback has not led to action and improvement. Reasons have included:

The organisation did not fully understand the selected assessment criteria and therefore the feedback provided by the assessor.

Top management disagreed with the feedback relating to the need to consolidate an asset management system.

The report provided by the assessor was extremely thorough and detailed and overwhelmed the organisation.

The organisation decided that it had insufficient resources to commit to delivering the recommendations proposed.

To ensure that value is realised from the assessment, especially in the case where an organisation is seeking its first asset management maturity assessment, we recommend the following:

Ensure that key people within the organisation, including the role that is engaging the assessor is knowledgeable in modern asset management thinking. This may require some learning and development.

Communicate expectations clearly to the assessor. This should include the goals of the assessment, the audience of the assessment report, and relevant context that may shape how the results are presented and the scope of recommendations.

Engage senior management in the process. Even where a formal business case to the senior management is not required, the rationale for the assessment should be communicated. The CEO and senior executive should be briefed on why they need to be involved in interviews. They should be invited to the closing meeting and/or presentation of the final report. If senior management are engaged, there is more likely to be support for improvement.

Develop an internal response to the assessor’s report. This may be a concise report that either endorses or rejects key findings of the assessment and sets out the actions that will be taken as a result. This process internalises the assessor’s feedback and translates the language so that it can be readily absorbed by internal stakeholders. This report is a foundation for the development of an Asset Management Roadmap (if it does not yet exist). The report should be approved by a relevant senior executive and include how delivery of the actions will be tracked.

Capture lessons learned from the assessment process so that they can be applied in future assessments.

Conclusion

Improving asset management maturity in New Zealand’s infrastructure is critical to New Zealand’s economic and social development. As the Infrastructure Commission identifies, asset management maturity assessments can support this outcome.

Our advice to organisations considering investing in an asset management maturity assessment is that they should carefully select the maturity assessment framework to apply and the assessor to engage. In this article we provide several factors to consider in making these decisions. We also argue that the organisation itself has an important role to play in ensuring the assessment ultimately delivers value.

Contact Us

Thank you for reading. If you have any questions on this article or would like tailored advice on this topic, please complete the form below and we will be in touch as soon as possible.